It’s easy to think that renter’s insurance isn’t necessary. But policies are easy to obtain and won’t put much of a dent in the pocketbook, according to one military financial expert.

“You need some coverage regardless of where you live and how much you own. It’s generally very inexpensive,” said Kate Horrell, an accredited financial counselor, chartered financial consultant, and military qualified financial planner.

The average cost of renter’s insurance is less than $150 per year, according to a 2024 NerdWallet analysis, though credit history, previous claims and location factor into the actual cost.

Renter’s insurance premiums also have decreased in the past decade, according to the Insurance Information Institute. And as of a 2022 report from “Insurance Business,” nearly 60% of renters have purchased renter’s insurance.

But when it comes to military families, Horrell said there are three common misconceptions surrounding renter’s insurance.

“First, that they don’t have enough stuff to need insurance. Second, that it is expensive. Third, that it only covers your things,” said Horrell, also a military spouse.

Regardless of how many possessions a person has, she said everyone should have homeowner’s or renter’s insurance.

“In addition to covering your belongings, it should provide coverage if you damage the rented property or if you need to relocate due to damage,” Horrell said. “Lastly, it covers your liability if there is an incident on your property, such as a neighbor tripping on your porch.”

While not legally required, the Department of Defense Office of Financial Readiness (DODFINRED) has stated that some landlords require it. Even when not required, DODFINRED encouraged service members to consider it.

Renter’s insurance coverage varies by company, but can include:

- Theft and vandalism

- Smoke, fire and lightning damage

- Flood and some other types of water damage

- Liability for a visitor’s injury or property damage

- Identity theft

- Military gear and uniforms

- Earthquake, building collapse and falling objects

- Explosions and riot damage

- Damage from aircraft

- Accidental tearing, cracking, burning or bulging

- Damage from artificially generated electrical current

- Personal liability

There are both broad and comprehensive forms of renter’s insurance, according to Military OneSource. Broad insurance is most common and “offers coverage for specific events named in the policy,” such as fires, explosions, vandalism, or theft. It also can include personal liability protection. Comprehensive insurance covers everything unless explicitly excluded in the policy.

However, there’s a distinction between renter’s insurance and rental insurance coverage, Horrell said.

“Renter’s insurance covers the property and liability of the renter of a home,” Horrell said. “Rental insurance covers the property and liability of the owner of a home that is being rented to someone else.”

The most important thing to consider when purchasing renter’s insurance, according to Horrell, is to ensure that the plan covers all belongings, even if they are second hand or “well loved.”

On the other hand, Brandon Lovingier, ChFC, MQFP, said the “biggest thing” when it comes to renter’s insurance is that renters understand what’s covered in their policy. They should also be aware if anything related to their coverage has changed, such as a growing family or upgrading furniture.

“But then also understand what types of coverages specific to where you’re going you might need to add,” Lovingier said, noting that areas with higher potential for natural disasters might need to be insured against.

Those who have renter’s insurance prior to a PCS would need to ensure that they update their coverage, especially since insurance rules are state specific.

First-timer renters, according to Lovingier, should think about how much coverage is needed versus what can be covered independently.

“There’s a lot of different specialty riders that insurance companies may want you to purchase,” Lovingier said, “and in some cases may be a good idea … but you don’t always have to cover everything. You have to weigh that risk.”

Setting up renter’s insurance is typically a quick process, Horrell said, so planning too far ahead isn’t necessary.

“While you might want to start earlier if you are comparison shopping, you can even wait until move-in day,” Horrell said. “But it’s probably easiest and most effective to set it up a few days before moving.”

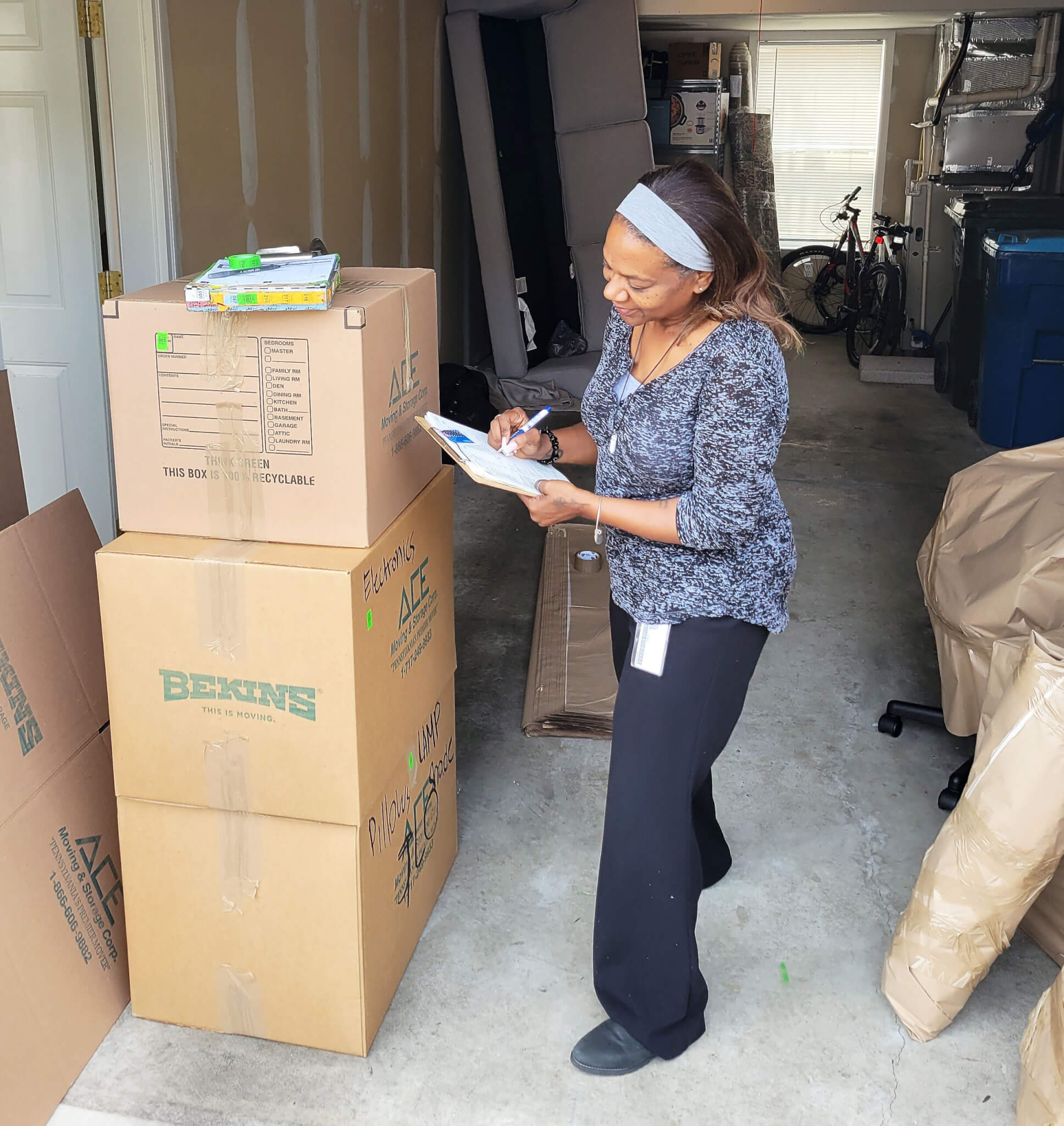

Renter’s insurance isn’t a topic that comes up a lot in the military community, says Lovingier. “In general,” he said, “we kind of assume that if something happens during the move, it’s going to fall on the moving company.”

But that’s not always the case, he added, emphasizing the need for military families in particular to always be prepared–and covered.

4 steps to obtain homeowners or renter’s insurance

- Assess your assets to determine the type of policy and how much coverage you need.

- Create video and photo documentation of belongings. Visit ready.gov for tips from the Federal Emergency Management Agency. Click on “Make a Plan,” then “Financial Preparedness.” Scroll until you see “Insurance.”

- Compare costs and policies.

- Look for a policy that provides the coverage you need at premium rates.

Read commentsSOURCE: https://finred.usalearning.gov/