In most families, parents take their kids on vacation. Not in our family.

A few years ago, I dreamed up a plan to take my dad, an aircraft technician with the U.S. Navy, to the Grand Canyon, a place both of us had always wanted to visit.

I had no idea how much such a trip would cost, but I was younger then — and persistent.

A couple months before dad deployed, I started saving. When I was 11, I opened a 12-month certificate of deposit at my financial institution, Navy Federal Credit Union. It was a great option to save money with a guaranteed return — and especially because my savings goal had a specific end date (dad’s return).

Birthday money, holiday gifts, cash from yardwork and other odd jobs — every cent I got my hands on went into my secret account. Well, it wasn’t secret from my mom; she helped me open it. But dad had no idea.

After he left, I mapped out the nearly 24-hour route from our home in Washington state to the famed national park in Arizona. I researched hotels, reviewed restaurants in the area and explored activities. Every day, I got more and more excited about spending some quality time with dad. I missed him.

After a year, I had socked away $1,100 — enough for several nights at hotels, tickets to an antique car museum and plenty of souvenirs. The day dad came back, friends and family came over for a welcome-home barbeque. When everyone left, I shared my surprise: a “grand” father-son adventure to the Grand Canyon.

“Yeah dude, you’re funny,” dad said. But I wasn’t joking, and soon after we headed out for the remote reaches of the southwestern desert.

A year of sacrifice

My gift required a full year of sacrifice, but it was well worth it.

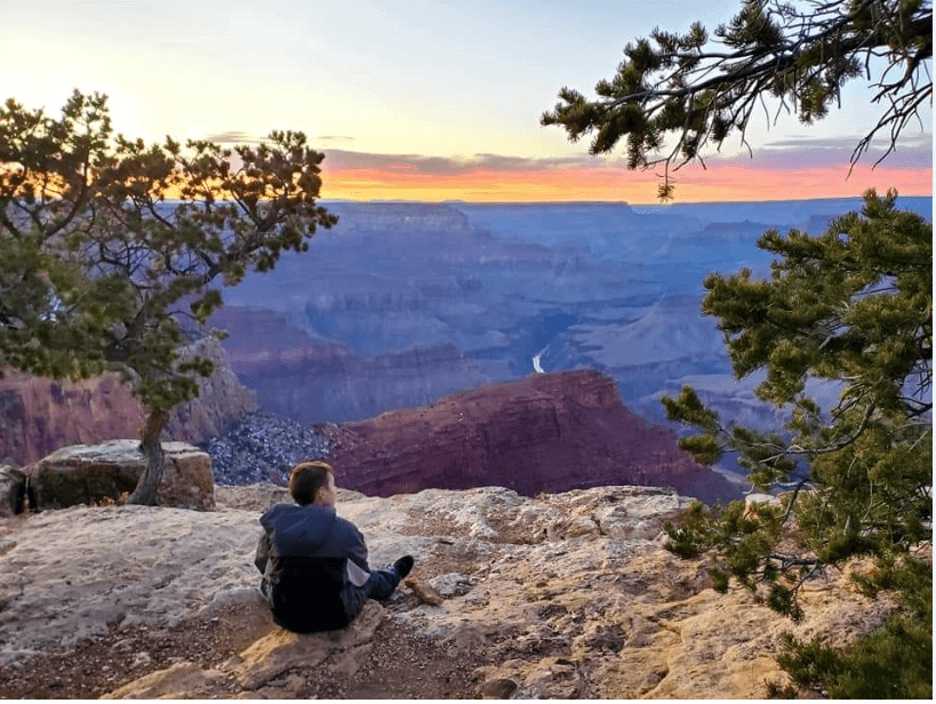

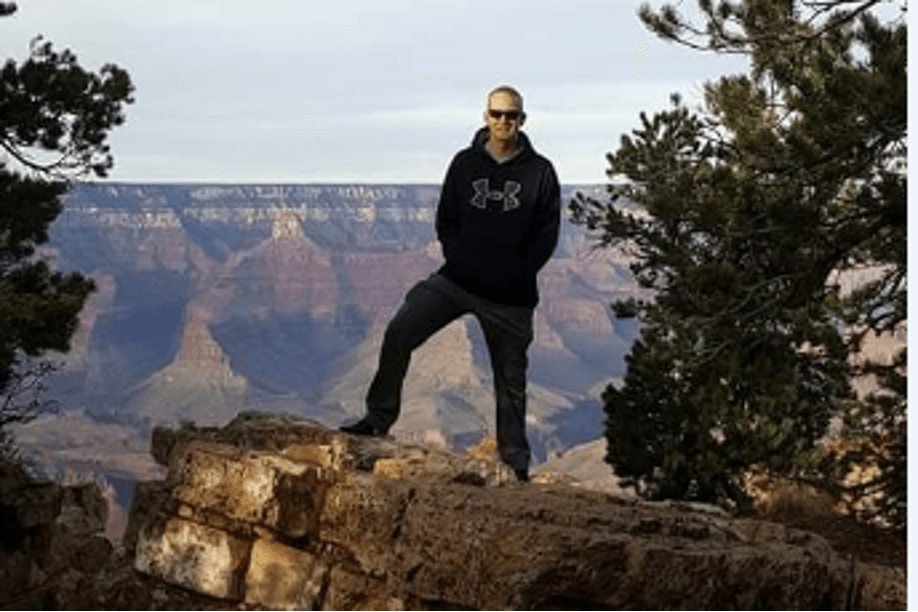

I got priceless dad time, and memories that will last a lifetime. A favorite one was a hike to a rock that juts out from a ledge of the canyon. Dad liked our father-son talks best, especially in the evenings as the sun set over the glowing rocks of the north rim, faded over the millennia to a rainbow of rustic reds and oranges.

Even at 11, saving wasn’t new to me. My mom, a member service representative at a Navy Federal branch in Chesapeake, Virginia, near where we live now, opened my first savings account — and that was before I could walk or talk.

She explained the benefits of putting my pennies in an interest-bearing account rather than a piggy bank on my dresser. She pulled out a calculator to demonstrate the dividends I’d earn in a high-interest CD. She said my money would grow with me — and it did. It was hard at first, but it got easier with every deposit I made toward my goal.

Out of the piggy bank

In the years since, mom has continued to teach my sister and me about how to manage our money to achieve our goals. I regularly log on to Navy Federal’s website and mobile app to learn smart money strategies in everything from savings and budgeting to credit and debt and college and life planning.

She says money management isn’t just for adults. Kids — with help from a parent or guardian — can open savings accounts too, and a lot do. About 40% of kids between the ages of 8 and 14 had a savings account in 2022, but that number should be higher. It’s never too early to develop responsible financial habits.

Every kid can become a saver if their parents or guardians follow my mom’s lead: opening savings accounts for their kids, with their kids, setting realistic goals and encouraging saving from an early age. They can also include kids in family spending decisions, such as what to buy at the grocery store and where to go on vacation.

These steps will help kids like me learn how to budget and save from an early age. For folks out there with big financial goals like mine, I suggest identifying a specific goal, such as $500, and regularly putting away a standard amount or percentage per dollars earned. You’ll build up to your goal without feeling like you have to limit short-term spending. Also, check out tools that make budgeting easier, like apps and prepaid debit cards, and different ways of budgeting (like 50-20-30 budgeting or reverse budgeting).

Dad deploys again this summer, and I’m saving for another major goal: a used car that Dad and I can repair together when he’s back. I’m going to buy a Honda Civic, the same type of car Dad got when he turned 16. With a focused budget, set timeline and plans to explore other tools to help my money grow, I’m hoping he can relive his youth, with me by his side. With $1,400 already in the bank, I’m on my way.