It is easy to ignore the “widow’s tax” until you are the widow. However, not all those affected by this bureaucratic penalty lose their significant others in combat, some lose them in a hospital bed.

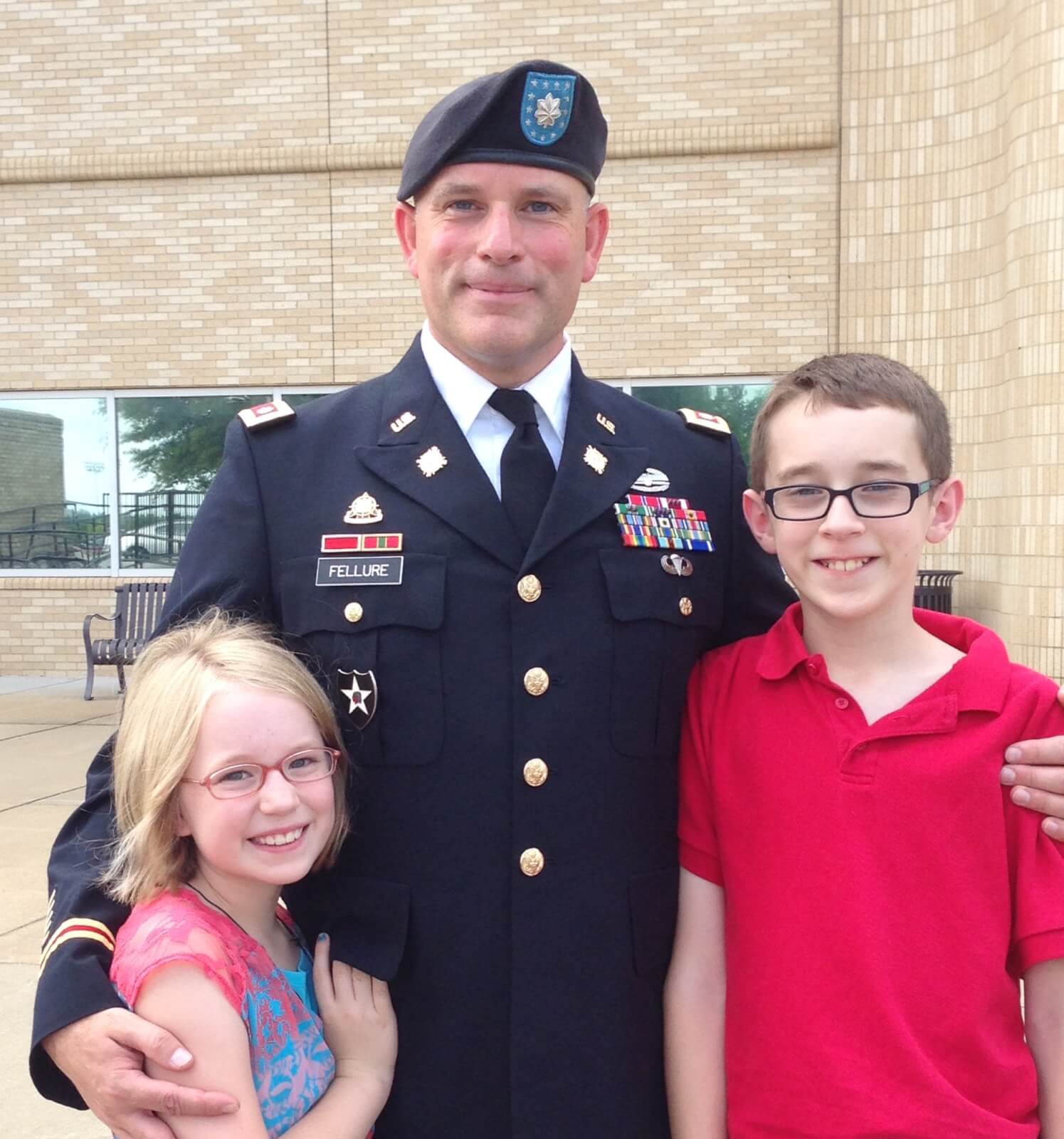

Army veteran and surviving spouse Kathryn Fellure didn’t know how the Survivor Benefit Plan – Dependency and Indemnity Compensation (SBP-DIC) offset would affect her until her husband, Lt. Col. Michael Fellure, died of service-connected esophageal cancer while on active duty in January 2019.

“I learned about the offset a week after my husband’s funeral. I thought, ‘this can’t be right. My husband earned this money.’”

Fellure is one of roughly 65,000 affected military survivors who do not receive full benefit payouts for their earned Survivor Benefit Plan (SBP) – Dependency and Indemnity Compensation (DIC) payouts due to US Code Title 10 law from 1972. This law withholds, or “offsets” VA benefits from retirement benefits earned by the service member. Not all military survivors qualify for both benefits. Only surviving family members qualify for both benefits and are subject to the SBP-DIC offset if their service member died as a result of their service.

In July 2019, Military Families Magazine reported on the details of what is known as the “widow’s tax” as the US House of Representatives voted to include a bill in the National Defense Authorization Act (NDAA) that would correct the SBP-DIC offset. Unfortunately, the Senate did not pass this legislation in their version of the NDAA.

Before a bill can be signed into law by the president, the House and Senate have to agree upon what to submit. Because these NDAA bills didn’t match, members of both the House and Senate went into “conference” after returning from their August recess on Sept. 9, 2019.

This recess allowed representatives to connect with constituents from their home states away from Washington politics. But it also slowed the momentum built this summer by a grassroots movement led by military widows and widowers who have had enough.

“I really want the active duty and of course Guard and reserves to see what’s going on. I know when you’re young and you’re healthy, you don’t see that you could come up with stage 4 cancer. That could never happen. We totally got punched in the gut when that happened to us,” said Fellure. “‘It’s gonna be somebody else.’ It’s almost like they’re in denial because they’re young and healthy.”

The original sponsors of this bill, Senators Doug Jones (D-Ala.) and Susan Collins (R-Maine), introduced a “motion to instruct” on the Senate floor on Sept. 25, 2019. Jones challenged his colleagues, “this is our time to make sure that we tell our veterans that we are supportive, but we show it with our actions, not just with our words.”

This nonbinding commitment directed Senate conferees to keep the House passed SBP-DIC language in the final version of the NDAA. This motion passed unanimously 94-0.

Many military members and families do not know what the NDAA is, but they should. It affects military pay, defense funding, spouse employment initiatives, family and veterans’ programming, a would-be wall and so much more that touches the everyday lives of service members.

Although support appears strong, there is no guarantee.

“Everything came out in our favor [the Sept. 25 Senate vote], but it’s nonbinding … They could totally flip it and not put it in. We’re at their mercy. It’s behind closed doors so we have no idea,” Fellure continued.

Help is still needed to see that this movement crosses the finish line. Surviving spouses are doing their part. Politicians have been supportive but need reminders that this is not just an issue for a small group of spouses.

How to help:

Contact your representative

Contact your senators

Call the Congressional Switchboard (202) 224-3121

Show support on social media by using #AxeWidowsTax

Read comments