Receiving orders for your next PCS move may bring a smile to your face — a new job, adventure, and opportunities await at the impending location. However, given how challenging a move can be, the acronym may elicit a less enthusiastic response — or worse — feelings of anxiousness or dread.

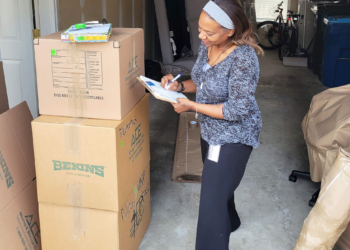

Megan Harless understands. A former transportation officer in the Army and a military spouse for 13 years, she’s moved 12 times. Through her Facebook group, Military Spouse Chronicles, families have posted about unpleasant moves.

“They had horrible experiences,” Harless said from her home in Red River, Texas, where she’s lived for two years with her husband and three children. “I wrote an open letter about PCSs to share them.”

The letter became a Change.org petition to improve the process. The U.S. Transportation Command took notice and soon made changes, as recommended by a committee Harless joined.

The changes were designed to make moves safer, faster, and less expensive. For example, starting in May, TSP movers approved to assist military families must have customer support available on Saturdays during the summer move period. They must also use tamper seals on boxes.

Earlier improvements included increasing crating, adding an around-the-clock hotline for troubleshooting, upping liability coverage, and requiring background checks for TSP employees.

Following orders

Harless advises starting preparations as soon as you receive your official orders. Your first source of help: Defense Personal Property System (DPS).

“Go online to Move.mil immediately to access DPS. Don’t wait until you find out your exact address,” she said. “You can update your information later. You want to get your move scheduled immediately.”

You can review the details and the dollar amount of your benefits, based on your rank and number of dependents, in the Joint Travel Regulations document. A summary of your benefits and more resources are available online and at Harless’s site PCSlikeapro.org.

Making your move less taxing

With luck, your expenses will all be covered — even if you decide to PPM it, electing for a Personally Procured Move. Formerly known as a DITY — a do-it-yourself move — this is an option, that allows you to be reimbursed for expenses.

Harless notes that the amount is now set at 100% reimbursement, up from 95% a year ago, as allowed by your rank and number of dependents.

No matter how you execute a PCS, you might qualify for tax breaks for non-reimbursed expenses. Jessica Muse, a retirement specialist with PARCO — a retirement planning company in Washington, D.C., notes that tax deductions can get you closer to covering your full moving costs if they weren’t already completely reimbursed by the military — as long as they are considered appropriate.

“Keep a checklist with research on reasonably priced hotels in the area if you’re claiming that cost,” Muses advised.

Other deductible expenses may include packing, packing supplies, crating, shipping, and rented trailers.

Your organizational skills will be tested once again as you track all of these expenses for possible tax deductions. Charlene Wilde, a military spouse, veteran, and now assistant secretary of AAFMAA, managed seven moves in the past 15 years. She found a number of ways to record costs, beyond stacking paper receipts together, including using banking apps that categorize charges, taking photos of receipts, and asking for e-receipts.

Related: Renter’s insurance provides relief for PCS nightmares

Whichever way you choose, gather the receipts to complete Tax Form 3903. As you track your deductions, ensure the total amount and earlier reimbursements do not add up to more than your expenditures. Wilde recommends working with a CPA or other tax professional familiar with military benefits to help you double-check for such potential mistakes.

Look beyond your moving expenses for additional tax breaks, too. You might have the option to keep residency in your home state and therefore lower or eliminate your state income tax.

“If your new state collects income tax, but you’ve kept residency in a home state that does not, it’s possible that the new state cannot enforce income tax,” Wilde said. “You might also be able to receive a refund on any withheld income taxes from your paycheck if you file as a non-resident.”

PCS lingo and resources to know before you go

- Transportation allowance: This covers the cost of moving your vehicles, based on your mileage.

- Per diem: The per-day payment to cover your meals, lodging, and other small expenses during the days you travel based on your approved number of moving days.

- TLE (Temporary Lodging Expense): You may receive approval for up to 10 days of temporary lodging for continental United States (CONUS) moves. This time may be before or after your move.

- TLA (Temporary Lodging Allowance): This is similar to TLE, but covers up to five days in the continental United States before your OCONUS move and up to 60 days after your move.

- DLA (Dislocation Allowance): This benefit helps cover extra costs, such as shipping a car, making a housing deposit, cleaning the home you’re leaving, or paying for pet-related expenses.

- GTCC (Government Travel Credit Card): Some service members can receive a credit card to cover expenses instead of being reimbursed.

- Weight Allotment: This is the amount of household goods you can move and be reimbursed for, based on weight. The amount is figured by your rank and your number of dependents.

- Pro-Gear Allotment: You are given a separate total of pounds allowed for shipment for equipment related to your and your spouse’s profession.