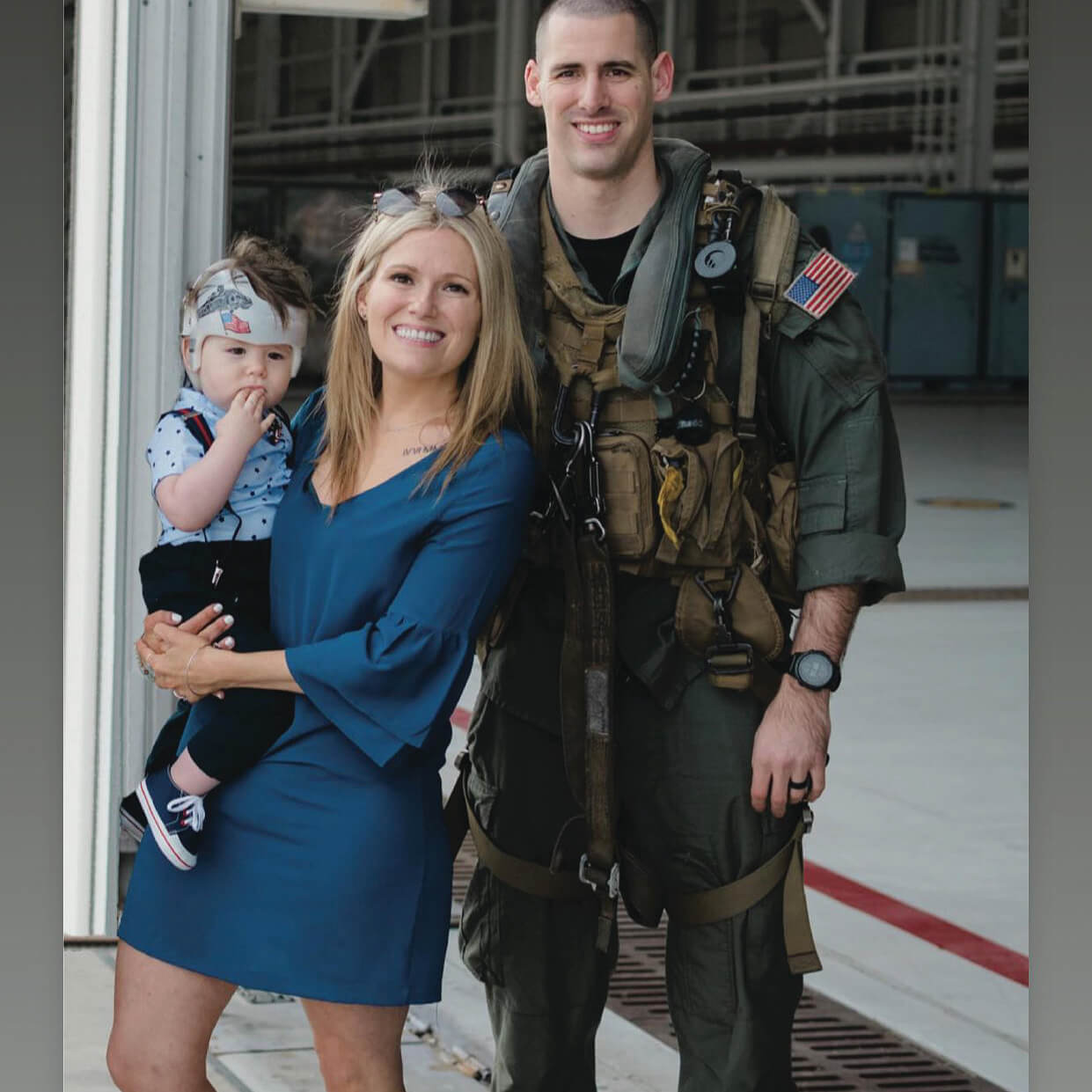

Nearly two years ago, Megan Buriak lost her husband, Naval Aircrewman 2nd Class James “Jimmy” Buriak, in a helicopter mishap off the coast of San Diego. Following Jimmy’s death, Megan experienced gaps in financial support that she expects were not unique to her.

Megan said that when a service member dies, their paycheck stops when the death is reported.

“Every situation is different, [however] during that time, there’s a period where you don’t get a check until the line of duty death verification is released,” she said.

As part of the Navy’s Casualty Assistance Calls Program (CACP), calls officers, as official representatives of the Secretary of the Navy, provide information and resources to next of kin. They also discuss benefits and entitlements due with the service member’s survivors.

“It can span anywhere from a couple of days to [as many as] 45 days following the mishap or the death of the service member,” Megan said.

Understanding pre-mishap matters

With Jimmy in the aviation community, Megan and her family secured a commercial life insurance policy just in case something catastrophic happened. Her worry was not without cause. According to Naval Safety Command data, the number of “class A mishaps” – aircraft crashes that happen in-flight and result in permanent total disability or a loss of life – continues to increase across the Navy and Marine Corps.

Jimmy’s commercial life insurance policy, which was separate from the Servicemembers’ Group Life Insurance, had an aviator clause. The aviator clause stipulated that the policy is null and void if a service member dies during a ‘non-airfare paying crash,’ such as a military flight required for military duties.

“It happened to my family,” Megan said. “I was denied two commercial life insurance policies. I have spoken to other widows of mishaps, and it has happened to them as well.”

Outreach for families

To fill these gaps, Megan created The AWS1 James Buriak Foundation.

A 501(3)(c) nonprofit, the organization aims to honor Jimmy’s memory by providing support, education and funding to families that lost a service member of the aviation community.

“My mission is to make sure that people know that, one, [death] can happen. Two, if you have a [commercial life insurance] policy, make sure that if you fly or there’s ever a chance that you may fly, you know that [an aviator] clause exists,” Megan said. “And three, how do I prepare families to ensure that commands, squadrons and service members know that, if anything ever happens, they’ve done everything they possibly can to prepare.”

The Foundation offers three outreach programs:

- The Pre-Mishap program, which aims to educate and prepare families to understand life insurance coverage, bank policies, procedures and loans.

- Post-Mishap, which covers the financial aspects of child care. Families in need get access to a 14-day supply of groceries and a 30-day supply of baby food, formula, diapers and wipes.

- 90-Day RoadMap, which helps families to navigate greater needs. Resources might include referrals to organizations like The Wingman Foundation, Fleet and Family, Tunnel To Towers and TAPS.

In upholding Jimmy’s legacy, Megan said that “he gave 110% to life and to everyone around him.” She plans to do the same for families of sailors and Marines lost to mishap incidents.