In today’s world, planning is essential, particularly when it comes to retirement. People are living longer and need a long-range care plan that can sustain them throughout their lifetime.

Regardless of the setting — home, assisted living facility, or nursing home — long-term care can be expensive. And the need for long-term care can happen at any time, not just in your later years, so making decisions about this type of care be difficult. The Federal Long Term Care Insurance Program (FLTCIP), the group long term care insurance program that only members of the federal family can apply for, can help.

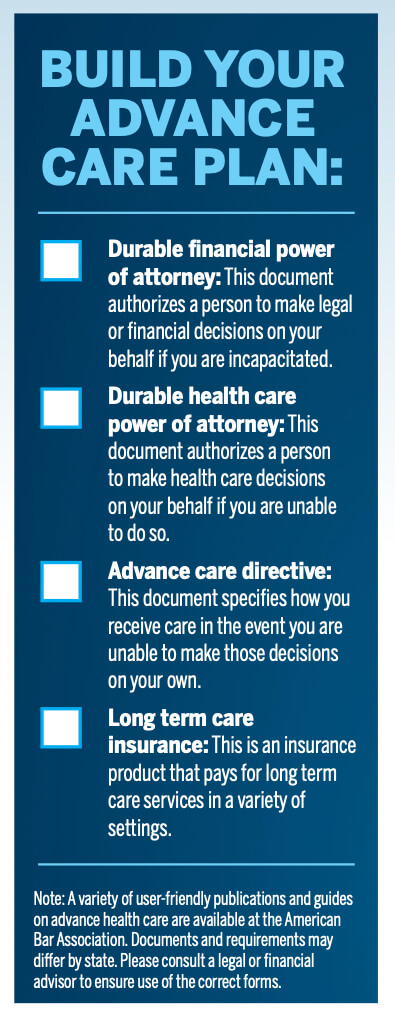

By starting the conversation with your spouse or loved ones now, you can relay your care preferences and communicate who will make decisions on your behalf if the need arises.

Here’s a list of five important reasons to start planning for long-term care now:

1. Cost and financial security

The cost of long-term care can be expensive and vary greatly depending on the type of care you receive, the place it’s provided, and where you live. For example, the national average cost for a semiprivate room in a nursing home is $92,725 per year. The FLTCIP helps protect your income, including pensions and annuities, plus your savings, or other investments, from being exhausted by long term care costs.

2. Insurance coverage

Many people think that long-term care is covered by traditional health insurance plans. It’s important to know that long-term care expenses are generally not covered by the Federal Employees Health Benefits (FEHB) Program, TRICARE, TRICARE For Life, or disability income insurance. While Medicare covers some care in nursing homes and at home, it does so only for a limited time and is subject to restrictions. The FLTCIP pays for long-term care services in your choice of settings (at home or in a facility, such as an assisted living facility, an adult daycare, or a nursing home) and your choice of caregiver.

The U.S. Department of Veterans Affairs provides limited long-term care services, with restrictions on who can receive them. And Medicaid — the joint federal-state program that pays for health care services for individuals who meet their state’s poverty guidelines — cannot be accessed until virtually all of your assets have been depleted to state-required levels and may provide little choice or control over the care you receive.

3. Family

Long-term care is most often provided at home by adult children, other family members, and friends. Even though they may be the first to step in and want to help, being a caregiver for someone who requires ongoing assistance can be a time-consuming commitment and often takes a toll on a caregiver’s health and well-being. Informal care provided by friends and family members is covered under the FLTCIP, as long as the caregiver isn’t your spouse or domestic partner and doesn’t live in your home at the time you become eligible for benefits.

4. Home care

Most people prefer to get the care they need in the comfort of their own home. The FLTCIP has a stay-at-home benefit that includes a range of services that support care in your home once you are benefit eligible — such as care planning visits, home modifications (such as installing wheelchair ramps), emergency medical response systems, durable medical equipment (such as wheelchairs, walkers, or hospital-style beds), caregiver training, and home safety checks — to help you maintain your quality of life in familiar surroundings.

5. Lifestyle

Many people wish to maintain their independence so they won’t have to rely on family members. Long term care insurance coverage under the FLTCIP can provide the means necessary to help pay for your care and allow you to spend your nest egg the way you want. Additional standard features include respite care, international benefits, and consumer protections, such as guaranteed renewable coverage and portability.

Plan ahead with the FLTCIP

To learn more about the FLTCIP’s comprehensive benefits and features, call 1-800-LTC-FEDS (1-800-582-3337) TTY 1-800-843-3557 or visit LTCFEDS.com/elearning to tune into our educational webinar series.

The Federal Long Term Care Insurance Program is sponsored by the U.S. Office of Personnel Management, insured by John Hancock Life & Health Insurance Company, and administered by Long Term Care Partners, LLC.

Read comments